How much does bad credit really cost?

Higher interest rates result in higher monthly loan payments and more money spent on interest. But how much does bad credit really cost? To find out, I compared interest rates for a mortgage loan and a new car loan using a high and a low credit score using the loan calculator at myfico.com.

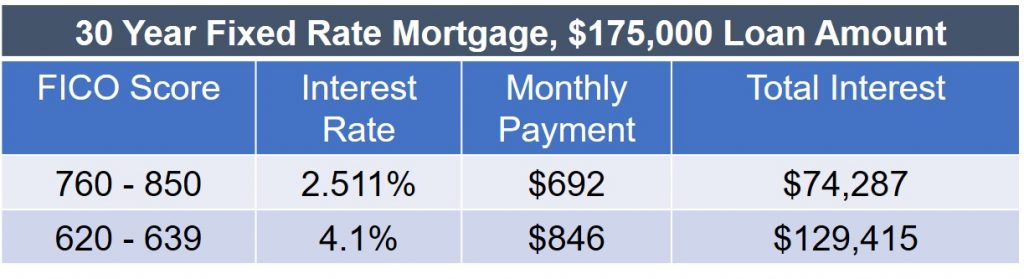

First, let’s take a look at a loan amount of $175,000 on a 30-year fixed rate mortgage. A person with a FICO score of 620 would pay $154 per month more than a person with a FICO score of 770. And over the life of the loan, the person with the lower score would pay an extra $54,951.

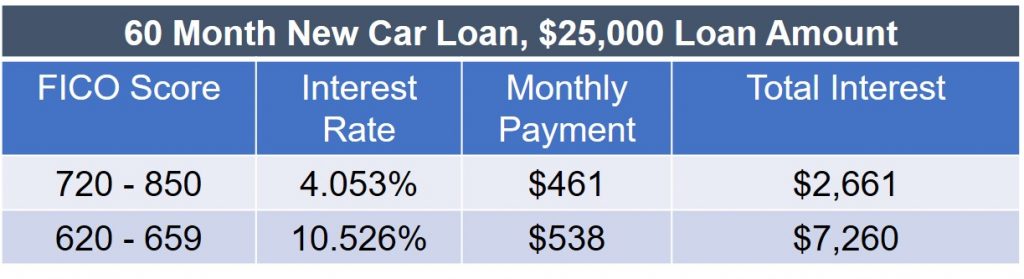

Next, let’s look at a loan amount of $25,000 on a new car for 60 months. A person with a FICO score of 620 would pay $77 more per month than if their score was 770. Over the life of the loan they would pay an extra $4,599 in total interest charges. (Also, just a one-point drop in the credit score, to 619, could result in an interest rate of 15.137% with a monthly payment of $597. That’s an increase of almost $60!)

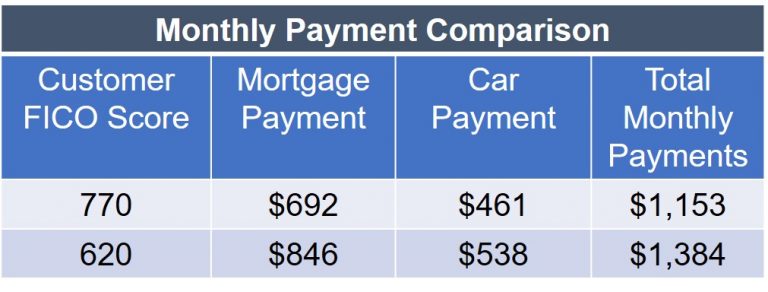

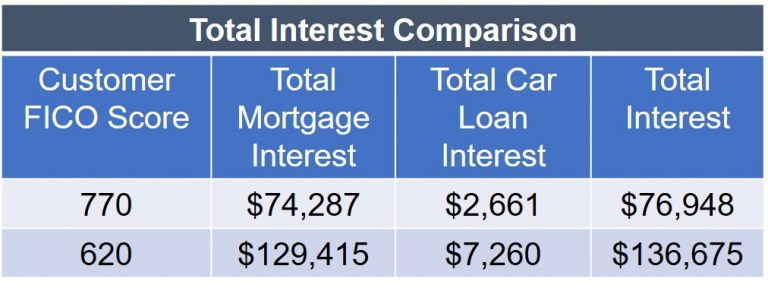

Comparison Overview

In my comparison, the person with the FICO score of 620 spends $231 extra per month for their mortgage and car. Not only that, but they will spend almost $60,000 more in total interest charges.

How bad credit scores affect interest rates

A credit score is simply a numerical representation of the information found in your credit report. Lenders use that information to determine how likely you are to repay a debt.

The FICO score range is a low of 300 to a high of 850. And there is a correlation between credit score and interest rates on loans. Lower interest rates are typically offered to people with higher credit scores. Likewise, people with lower credit scores are offered higher interest rates. That’s because people with lower credit scores are considered greater risks for defaulting on their loans.

Penalties of a bad credit score

A low credit score can cost you more than just higher interest rates. It may result in higher down payment requirements or an inability to get a loan. While a score below 500 is considered bad, you will be hard pressed to get a mortgage loan with a score under 620. And with a score that low, you may even have difficulty renting an apartment.

By the way, if you’d like to learn more about everyday money matters, consider the Hire Your Money® course. It is a cutting edge, cloud-based interactive course that empowers young people to take command of their money lives. You will be able to access the course on your favorite internet-enabled device. No reading required. Included are presentations about must-know money topics, videos, and downloadable money tools.